Good afternoon this is christopher tipper ceo of hunter benefits co-host of on the couch and co-host of today's video our tuesday topic this is christina cannon and you also know her from the washington update from on the couch now the tuesday topic is our attempt at being serious about serious subjects but we usually end up being well being more amusing than on the couch right it is something like that yes it is the government our monthly tuesday topic is where we discuss in q a format a white paper that christina has written for us they can get very heavy and weighty at times today we are talking about vfcp the voluntary fiduciary corrections program i did read the paper beforehand but anyways so i've got nine i think nine or ten questions for her are you ready christina ready or not i did look at the questions there was only one i didn't know the answer to oh this should be good all right so first off who is ebsa and why did they develop a voluntary fiduciary correction program it is the employee benefits security administration branch of the department of labor okay the department of labor's whole focus in qualified plans is to keep them going and not to shut them down right however if you run afoul of erisa or government regulations they could come in and close your plan i'm just thinking that the vfcp is a response and acknowledgement of basic human nature we're going to do stuff wrong uh yeah well though the rules are so complicated it's almost impossible not to do it but again because it's voluntary this is a planned sponsor turning themselves in so to speak it's a mia copa yeah now then who is...

PDF editing your way

Complete or edit your vfcp fiduciary application anytime and from any device using our web, desktop, and mobile apps. Create custom documents by adding smart fillable fields.

Native cloud integration

Work smarter and export vfcp application directly to your preferred cloud. Get everything you need to store, synchronize and share safely with the recipients.

All-in-one PDF converter

Convert and save your dol voluntary fiduciary correction as PDF (.pdf), presentation (.pptx), image (.jpeg), spreadsheet (.xlsx) or document (.docx). Transform it to the fillable template for one-click reusing.

Faster real-time collaboration

Invite your teammates to work with you in a single secure workspace. Manage complex workflows and remove blockers to collaborate more efficiently.

Well-organized document storage

Generate as many documents and template folders as you need. Add custom tags to your files and records for faster organization and easier access.

Strengthen security and compliance

Add an extra layer of protection to your vfcp form by requiring a signer to enter a password or authenticate their identity via text messages or phone calls.

Company logo & branding

Brand your communication and make your emails recognizable by adding your company’s logo. Generate error-free forms that create a more professional feel for your business.

Multiple export options

Share your files securely by selecting the method of your choice: send by email, SMS, fax, USPS, or create a link to a fillable form. Set up notifications and reminders.

Customizable eSignature workflows

Build and scale eSignature workflows with clicks, not code. Benefit from intuitive experience with role-based signing orders, built-in payments, and detailed audit trail.

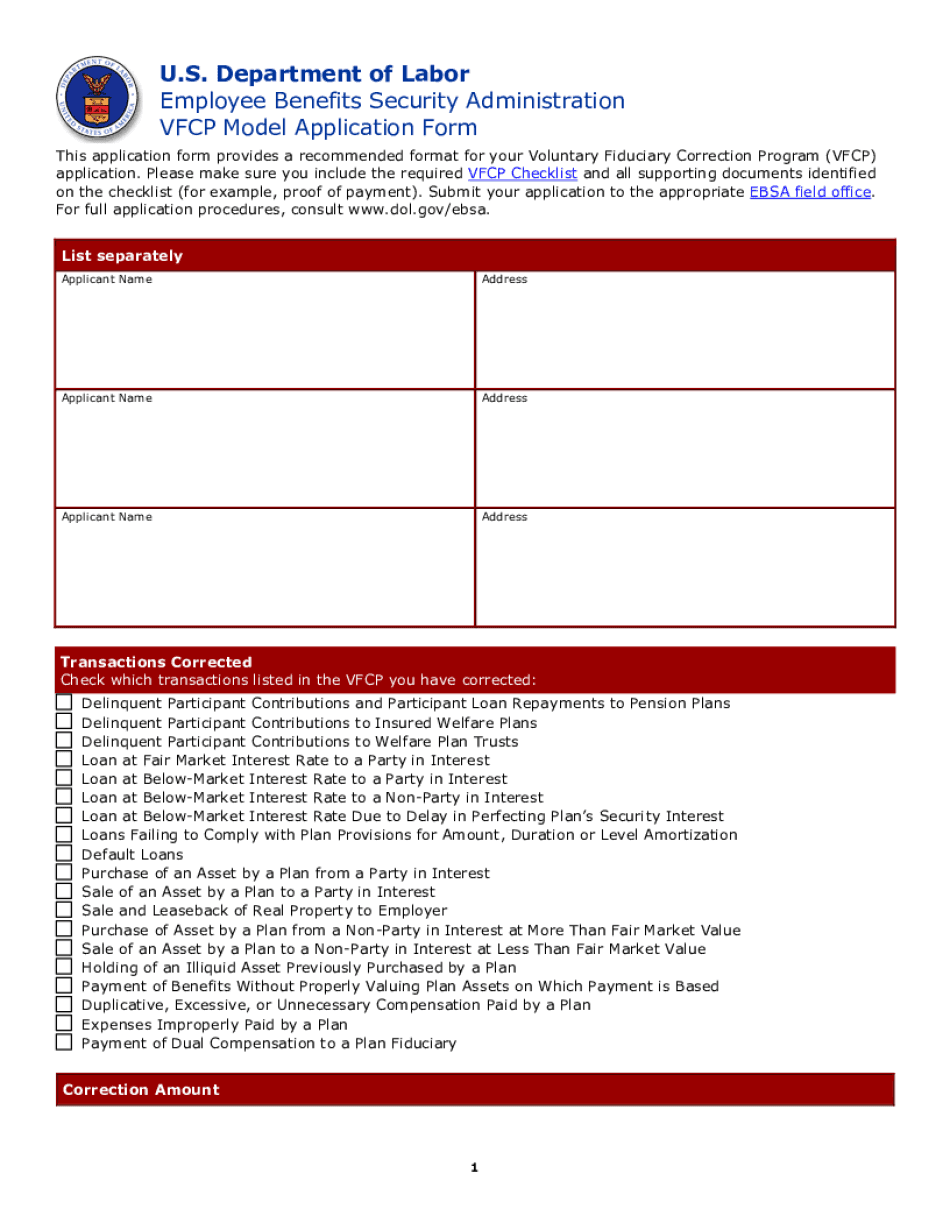

What you should know about VFCP Application

- The VFCP application form must include proof of payment of excise tax if applicable.

- Applicants must provide complete documentation as outlined in the VFCP Checklist.

- All corrections made to the plan must be listed in the VFCP application.

Award-winning PDF software

How to prepare VFCP Application

About Vfcp Application Form

The VFCP (Voluntary Fiduciary Correction Program) Application Form is a document provided by the United States Department of Labor (DOL) for employers or plan officials who want to correct certain transactions or practices not in compliance with the Employee Retirement Income Security Act (ERISA). The VFCP Application Form is used by those who administer a retirement or pension plan, such as employers, plan sponsors, fiduciaries, investment managers, or administrators. It can be utilized for both private sector and government-sponsored retirement plans, such as 401(k), profit-sharing, or pension plans. The purpose of this form is to allow individuals or organizations to voluntarily correct breaches or violations of ERISA's fiduciary responsibilities, reporting, or disclosure requirements. By utilizing the VFCP, plan sponsors can avoid potential penalties, legal actions, or DOL investigations that may arise from non-compliance with ERISA regulations. The VFCP Application Form guides the plan administrator through the process of identifying the correction, calculating the amount of correction required, and providing the necessary information to the DOL regarding the correction made. It ensures that the voluntary correction is properly documented and submitted to the Employee Benefits Security Administration (EBSA) of the DOL for review and approval. While the use of the VFCP Application Form is not mandatory, it provides a structured and systematic approach for rectifying ERISA violations. It is recommended for those who discover compliance issues within their retirement or pension plans and wish to address them proactively to maintain legal compliance and protect the interests of plan participants and beneficiaries.

People also ask about VFCP Application

What people say about us

Complex paperwork, simplified

Video instructions and help with filling out and completing VFCP Application