Award-winning PDF software

Vfcp filing cost Form: What You Should Know

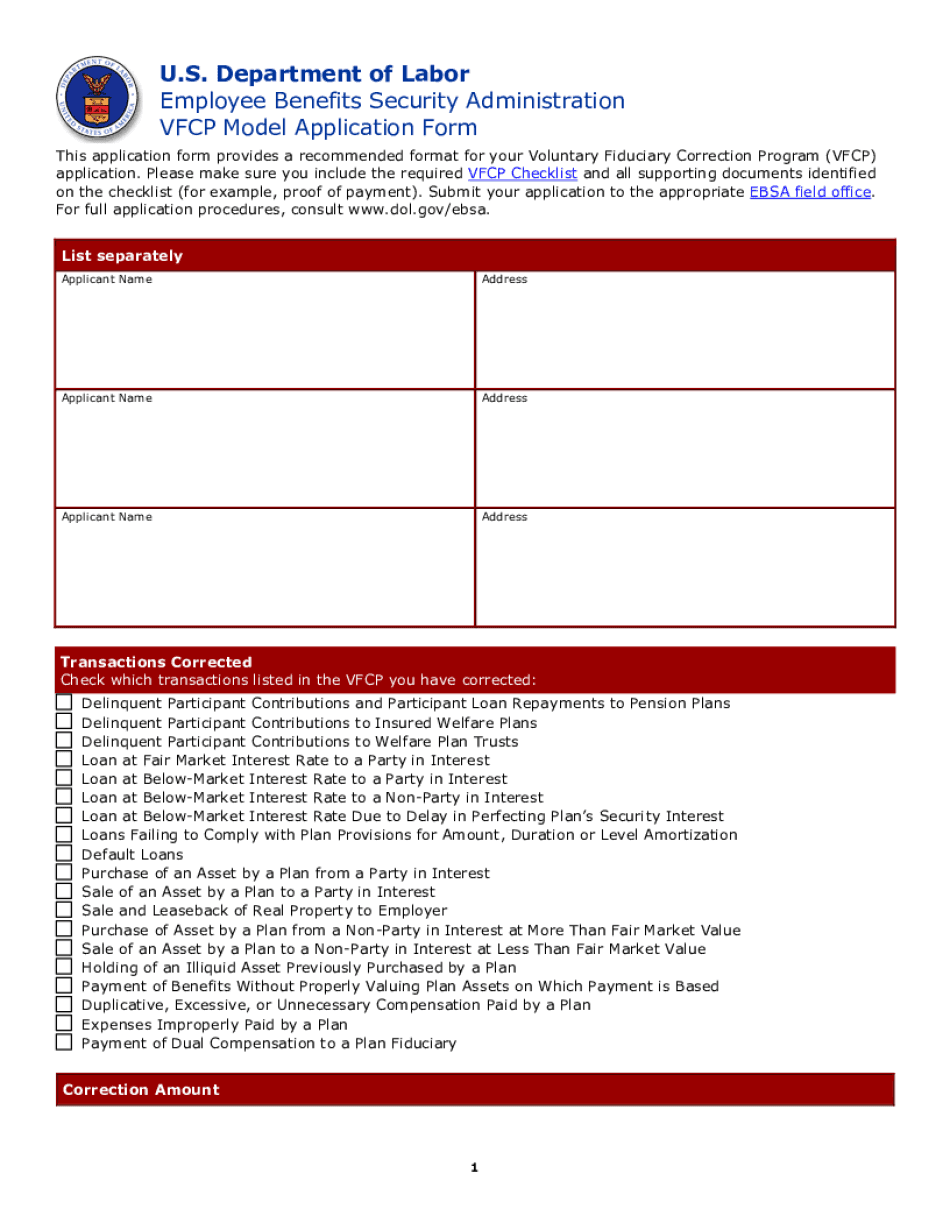

The Voluntary Fiduciary Correction Program (FCP) can help individuals, including employees and officers, correct and/ or mitigate their failures to account for their interests in a plan that is an ERIC within a specified time, including the following: (a) Eric of plans in excess of 20 (i.e., over 400-900 members) (b) Members of multiple-employer plans (i.e., a SEP, SIMPLE IRA, or other SIMPLE IRA plan) (c) Participants in a qualified retirement plan whose plan was terminated for failure to correct a material violation within 60 days of its termination. For example, the plan was terminated due to violations including failure to file an amended return, failure to timely pay a debt, failure to timely deduct a payroll penalty, or failure to timely file and maintain an accurate accounting. Ineligible for the program: Employers (a) that fail to file an ERIC election for 10 or more employees within the 3-year period (which is required for ERIC applications filed before June 15, 2010) (b) that fail to timely file and post on the ERIC website at least 2 periodic statements for any 30 days of the 6 months prior to the filing of the application (which are required from the 90-day filing deadline to the 45-day deadline) or the earliest of the 3 filing deadlines after the employer failed to timely file an ERIC election. Employers should refer to their written employment contract, in the employee handbook or other appropriate document, for specific language regarding their application deadline. Applicants that fail to timely file and post the correct statements on the ERIC website do not qualify for the program. However, upon timely filing and posting of the Corrected Statement, an employee is eligible to participate. See ERIC Application for more information. Voluntary Correction Program (FCP) Fees— IRS The initial fee will be 10,000, including a 250 fee for each plan affected in excess of 20 plans. An additional fee is due for each plan. The maximum fee is 750 for each plan over 400 members.

Online solutions help you to manage your record administration along with raise the efficiency of the workflows. Stick to the fast guide to do Vfcp Application Form, steer clear of blunders along with furnish it in a timely manner:

How to complete any Vfcp Application Form online: - On the site with all the document, click on Begin immediately along with complete for the editor.

- Use your indications to submit established track record areas.

- Add your own info and speak to data.

- Make sure that you enter correct details and numbers throughout suitable areas.

- Very carefully confirm the content of the form as well as grammar along with punctuational.

- Navigate to Support area when you have questions or perhaps handle our assistance team.

- Place an electronic digital unique in your Vfcp Application Form by using Sign Device.

- After the form is fully gone, media Completed.

- Deliver the particular prepared document by way of electronic mail or facsimile, art print it out or perhaps reduce the gadget.

PDF editor permits you to help make changes to your Vfcp Application Form from the internet connected gadget, personalize it based on your requirements, indicator this in electronic format and also disperse differently.