Award-winning PDF software

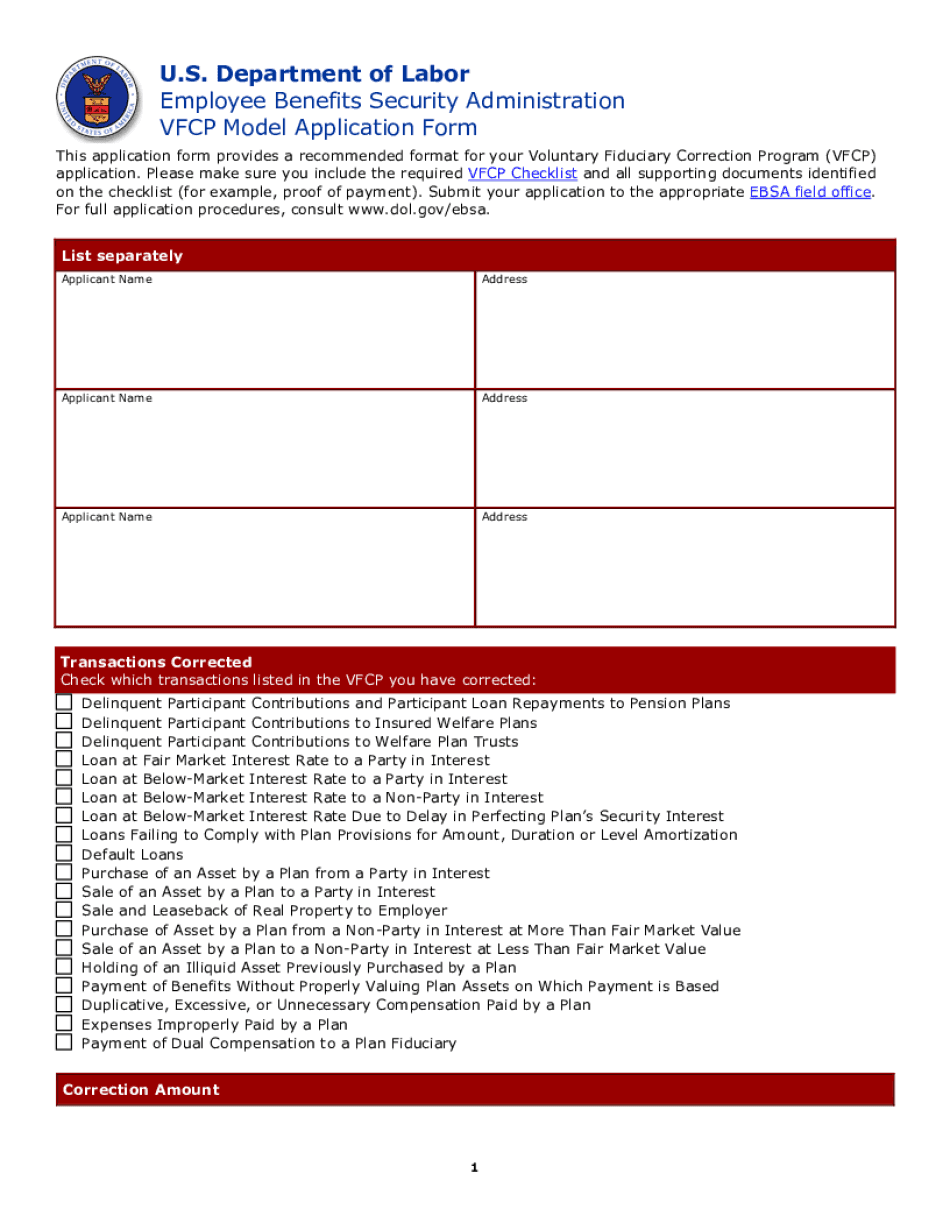

Dol vfcp self correction Form: What You Should Know

Aug 31, 2025 — The National Institute of Standards and Technology (NIST) is developing guidance on how to administer the Voluntary Fiduciary Correction Program (FCP). Aug 31, 2025 — The IRS issues a notice on how taxpayers can request information to enable them to determine their eligibility or correct errors in their retirement plan. Aug 31, 2025 — IRC Section 530C requires an individual to file a report in order to become exempt from an annual nondisclosure fee imposed by an employer. Sep 18, 2025 — IRS publishes Guidance for Filing Report(s) with the Department of Labor (DOL) on how to file Form 5500, Voluntary Fiduciary Correction Report. Oct 17, 2025 — The Voluntary Fiduciary Correction Program (FCP) provides Plan Sponsors with instructions and information regarding how to self-correct fifteen specific prohibited transactions and ineligible distribution activities by plan participants. Oct 18, 2025 — The U.S. Department of Labor (DOL) issues guidance on how to administer the Voluntary Fiduciary Correction Program. Filing Form 5500, Voluntary Fiduciary Correction Report (PDF) | IRS Nov 18, 2025 — The Voluntary Fiduciary Correction Program (FCP) offers Plan Sponsors the opportunity to self-correct thirty-five specific prohibited transactions and ineligible distribution activities by participants. Nov 24, 2025 — The IRS issues guidance on the voluntary Fiduciary Correction Program (SCP) to plan sponsors. Dec 14, 2025 — IRC Section 530C requires individuals filing a tax return to file a report identifying whether, for a qualified organization (including a retirement plan) the organization made a distribution of property from, or in connection with, an individual's plan, with certain exceptions. Dec 14, 2025 — IRC Sections 530F-530K define and establish the manner in which an eligible individual's plan may self-correct certain prohibited transactions and ineligible distribution activities and provide the rights of an eligible individual and plan participants in relation to the self-correcting plan. Dec 21, 2025 — The IRS issues notice on how to file a Form 5500, Voluntary Fiduciary Correction Report (PDF).

online solutions help you to manage your record administration along with raise the efficiency of the workflows. Stick to the fast guide to do Vfcp Application Form, steer clear of blunders along with furnish it in a timely manner:

How to complete any Vfcp Application Form online: - On the site with all the document, click on Begin immediately along with complete for the editor.

- Use your indications to submit established track record areas.

- Add your own info and speak to data.

- Make sure that you enter correct details and numbers throughout suitable areas.

- Very carefully confirm the content of the form as well as grammar along with punctuational.

- Navigate to Support area when you have questions or perhaps handle our assistance team.

- Place an electronic digital unique in your Vfcp Application Form by using Sign Device.

- After the form is fully gone, media Completed.

- Deliver the particular prepared document by way of electronic mail or facsimile, art print it out or perhaps reduce the gadget.

PDF editor permits you to help make changes to your Vfcp Application Form from the internet connected gadget, personalize it based on your requirements, indicator this in electronic format and also disperse differently.