Award-winning PDF software

Employee benefits security administration phone number Form: What You Should Know

As part of our ongoing commitment to inform you of our programs and programs issues, we have made this information available for you to view online. See also our information on Social Security. For more information, see. Pension Benefits A pension is an annuity paid by the government to a retired person for his or her employment with a Federal agency, state (including school districts), or political subdivision, during a given lifetime. A pension is a separate annuity, unlike an annuity paid to a worker in a lump sum or as part of a pension, for example. Most workers are called to participate in a pension plan during retirement and are paid monthly installments, as pension income, in the form of an annuity. (Pension income is taxable.) PEERS can provide benefits through a group or individual plan, so a worker can collect a pension from the PEERS pension fund for his or her entire career. Pensions do NOT require Social Security benefits, and a worker or his or her beneficiary cannot access both PEERS benefits and regular benefits through federal, state, or school benefits programs. A full retirement annuity (including a pension and earnings on it for life) requires a higher contribution than a pension. Social Security collects the contributions and pays the annuity for the worker and his or her spouse or dependent. The PEERS employer contribution equals 60% of the monthly payments required by law. A worker is also entitled to a partial annuity from Social Security. This happens when he or she is unable to work at full capacity for reasons such as an active duty military service member, a civilian employee who is at least 42 months of age, an unemployed worker who has been absent from the workforce for a continuous period of at least 12 months and has not been actively seeking employment, an absent worker who is disabled as a result of a condition related to his or her job, an individual who is the mother of a child under age 15, and for other reasons that the Social Security Administration establishes. This annuity is payable to the retired worker's spouse or a dependent child only if that family member has already been financially dependent on the worker for at least 12 months before beginning payments to the worker.

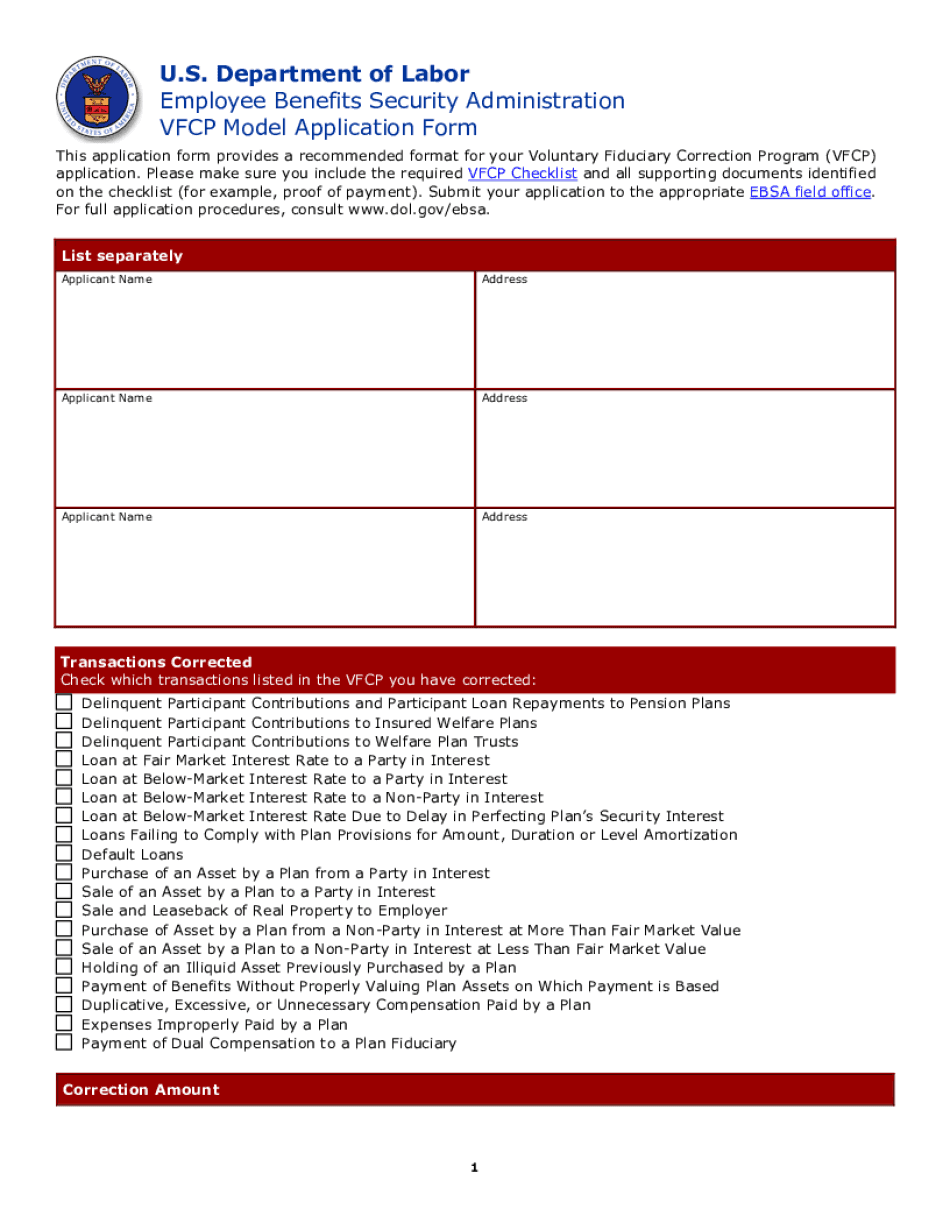

online solutions help you to manage your record administration along with raise the efficiency of the workflows. Stick to the fast guide to do Vfcp Application Form, steer clear of blunders along with furnish it in a timely manner:

How to complete any Vfcp Application Form online: - On the site with all the document, click on Begin immediately along with complete for the editor.

- Use your indications to submit established track record areas.

- Add your own info and speak to data.

- Make sure that you enter correct details and numbers throughout suitable areas.

- Very carefully confirm the content of the form as well as grammar along with punctuational.

- Navigate to Support area when you have questions or perhaps handle our assistance team.

- Place an electronic digital unique in your Vfcp Application Form by using Sign Device.

- After the form is fully gone, media Completed.

- Deliver the particular prepared document by way of electronic mail or facsimile, art print it out or perhaps reduce the gadget.

PDF editor permits you to help make changes to your Vfcp Application Form from the internet connected gadget, personalize it based on your requirements, indicator this in electronic format and also disperse differently.